Working Capital: Definition and Formula

Content

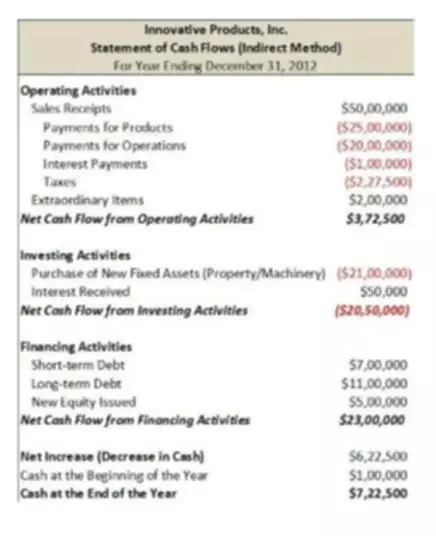

It can use this money for investments, product development, new projects and more. However, if a company is holding on to excess working capital without making any efforts to use it, it’s missing opportunities for growth. A cash flow forecast can help SMEs anticipate their cash inflows and outflows and identify potential cash shortfalls. It allows SMEs to plan for future working capital needs and take appropriate action to improve their cash position. By reducing operating expenses, a company can free up cash that can be used to improve net working capital.

Examples of liabilities that affect your working capital are accounts payable, short-term loan repayments, payroll dues, or inventory dues. Looking at it mathematically, it is actually a ratio that defines the difference between an organization’s assets and its liabilities. The main goal of capital is to determine how liquid a company’s assets are at any given point. This liquidity will define the company’s ability to meet its dues and business expenses. Current assets typically include cash, marketable securities, accounts receivable, inventory, and prepaid expenses.

Operating Expenses

For example, interest on short-term and long-term loans taken to finance such current assets. Pvt Ltd has the following current assets and liabilities on its balance sheet dated 31st December 2019. Furthermore, it helps in studying the quality of your business’s current assets. Examples of your current liabilities include accounts payable, bills payable, and outstanding expenses.

Net working capital considers the amount of money tied up in inventory and accounts receivable, which are not immediately available to pay off debts. Simply put, Net Working Capital (NWC) is the difference between a company’s current assets and current liabilities on its balance sheet. It is a measure of a company’s liquidity and its ability to meet short-term obligations, as well as fund operations of the business. The ideal position is to have more current assets than current liabilities and thus have a positive net working capital balance. In this light, the aforementioned first formula is deemed as the widest; it entails all accounts, whereas the other formula is the narrowest as it only involves three accounts.

Accounting Treatment of Net Working Capital

Additionally, NWC changes often, and some companies have a seasonality to their business — one part of the year requires relying on financing, while another part is booming with profits. NWC is most commonly calculated by excluding cash and debt (current portion only). Datarails’ FP&A software replaces spreadsheets with real-time data and integrates fragmented workbooks and data sources into one centralized location. This allows users to work in the comfort of Microsoft Excel with the support of a much more sophisticated data management system at their disposal.

Current assets listed include cash, accounts receivable, inventory, and other assets that are expected to be liquidated or turned into cash in less than one year. Current liabilities include accounts payable, wages, taxes payable, and the current portion of long-term debt that’s due within one year. The formula for calculating net working capital is simple, but it is important to only include current assets and liabilities.

Extend accounts payable payment terms

A good rule of thumb is that a net working capital ratio of 1.5 to 2.0 is considered optimal and shows your business is better able to pay off its current liabilities. This is to ensure that your business maintains a sufficient amount of Net Working Capital in each accounting period. Such an optimal level of Net Working Capital ensures that your business is neither running out of funds. Also, the Net Working Capital indicates the short-term solvency of your business. It helps your creditors to know your liquidity position before supplying goods or services on credit to you .

Failing to do something to turn the problem around could lead to significant problems in the future. Gross and net working capital are measures of a company’s liquidity, but they are calculated differently and provide different information. It includes money owed to the company by its customers for goods or services sold on credit. Positive net working capital can allow businesses to take advantage of potential investment opportunities, such as investing in new projects, expanding operations, or acquiring other companies. Chris Rauen has been educating procurement and finance professionals on accounts payable automation and procure-to-pay transformation for more than 20 years.

As a result, your suppliers and banking partners offer discounts and extend more trade credit. Such a continuous flow of funds ensures you purchase raw material and produce goods uninterruptedly. Adequate Net Working Capital ensures that your business has a smooth operating cycle. This means the time needed to acquire raw material, manufacture goods, and sell finished goods is optimum. However, each period of negative working capital deserves close attention.

- If a company has positive working capital, then it has money to invest and grow the business.

- The majority will accept the new, extended payment terms, freeing up working capital that you can use for your business.

- Efficient working capital management can lead to a shorter CCC, which indicates a positive cash flow and a healthier financial position.

- Working capital fails to consider the specific types of underlying accounts.

- If your company’s NWC falls in line with the industry average, this is considered acceptable.

- On the other hand, if a company increases its inventory levels, it may see a decrease in cash, negatively impacting its net working capital position.

An adequate amount of Net Working Capital helps you to face shocks and peaks in demand. Besides this, you will be able to sell products to your customers at a discount. This is typically the case with the https://www.bookstime.com/ manufacturing units and certain wholesaling and retailing sectors. Therefore, financial managers must develop effective working capital policies to achieve growth, profitability, and long-term success.

Changes to Net Working Capital

By maintaining a healthy level of working capital, a company can better manage risks such as customer defaults or supply chain disruptions that can impact its cash flow and financial stability. It’s important to note that having negative net working capital does not necessarily mean that a company is in financial trouble. Companies net working capital meaning with negative net working capital may need to improve their working capital management, such as enhancing their collections processes or negotiating better payment terms with suppliers. A ratio of less than one, where liabilities exceed assets, is a sign of trouble, indicating a business may not have enough cash to pay its bills.

The company has enough cash to repay its dues, while also focusing on improving the business. A positive net working capital is one where the company can meet its obligations while still having remaining funds for investments, expansion, extended operations, and even emergencies. Working capital accounting is crucial to know where the business stands since it is its main source of payable.