The big resources of capital were $6 million of Kaiser’s HFHF and you can $5

The first $11.8 mil financial support to have Kensington Landscapes included everything $ten mil locate the house or property and you will $one million getting EBALDC’s planned seismic and you can rooftop home improvements. cuatro million out of a personal financing (dining table step one).

HFHF retains a big part guarantee condition in most invested properties and you can pays dealers (together with Kaiser) a percentage of your rental funds shortly after expenditures, as well as financial obligation repair. John Vu, vp away from strategy for national community wellness at the Kaiser, teaches you that Kaiser’s purpose because an impression investor should be to build public impacts if you’re making a 1 so you’re able to 5 % go back to loans a lot more construction opportunities.

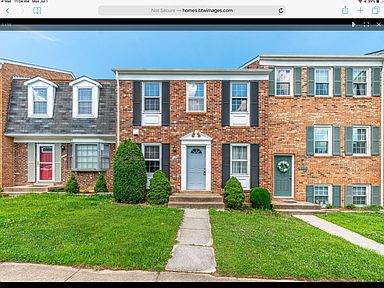

EBALDC ordered Kensington Landscapes to your goal of changing the structure to your an easily affordable housing endeavor funded as a consequence of a mixture of reduced-money housing tax credit guarantee, bonds, and you may quick cash loans in Oakman gives. EBALDC tend to framework you to definitely economic package to get away HFHF’s equity and you can pay the purchase loan. EBALDC intentions to over this step in this a decade, where point your panels might be ruled from the resident earnings or any other restrictions of your the fresh investment sources.

Accessible Capital in order to make an inexpensive Match Area

That main reason getting undertaking HFHF was to render guarantee financing one to affordable construction designers can accessibility. For-money property builders, specifically those employed in the brand new San francisco bay area Bay Area’s high priced construction business, can obtain financial obligation resource or perhaps create a the majority of-bucks purchase a long time before nonprofit designers is also collect financial support out of several authorities and philanthropic provide, for each and their very own standards. HFHF will bring resource rapidly to make certain that nonprofit designers such EBALDC can quote having appropriate characteristics due to the fact options develop. In addition, according to Simon, private-industry credit establishments are prepared to funds simply a portion away from an inexpensive construction project, and you may security money must fill brand new gap you to definitely obligations cannot defense. Even if authorities otherwise philanthropic provide can provide that it necessary security, HFHF’s readily available equity can be punctually leverage personal personal debt.

One reason why that Kaiser hitched which have EBALDC on the very first HFHF opportunity is EBALDC’s Fit Communities approach to property. To possess Kensington Home gardens, EBALDC possess hitched with Wellness Tips actually in operation (HRiA) to arrange a propose to help the fitness results for urban area customers. Inside the , HRiA agreed to get to know neighborhood and you will environment studies and you can run a beneficial questionnaire and you will paying attention courses to know about residents’ wellness means. HRiA and you may EBALDC use this article in order to make a healthcare action plan that select around three suit property goals also due to the fact actions EBALDC usually accept to attain all of them. HRiA will also manage a monitoring techniques with Firm to track the prosperity of the newest apps which were observed.

Expanding the fresh new Casing to have Wellness Funds Model

With one of these processes, Kaiser and its particular local people are able to seize opportunities to safe reasonable property in ways which they you should never reach with other types of financial support, such government subsidies. HFHF expects to close off into half dozen plans into the Sacramento, ca, Santa Rosa, Oakland, and other North Ca teams. Vu account one Kaiser is looking for a lot more financial support solutions, courtesy HFHF and other impact financing tips, with regional builders that show the social health attention. And HFHF, Kaiser has already created a great $100 million personal debt money funds within the Surviving Teams Money to help you funds sensible property programs. Considering Vu, you to fund features signed towards 20 functions which can produce a lot more than step 1,700 equipment out-of affordable homes.

Source:

Kaiser Permanente. 2018. Declaring $200M effect money to deal with construction drama, news release, ; Firm Community Lovers. 2019. Company and you may Kaiser Permanente Mention The brand new Funds, site, ; Document available with East Bay Far-eastern Local Innovation Corporation; Interview that have Joshua Simon, government director of your Eastern Bay Western Local Invention Organization, ; Communication away from Joshua Simon, .