Functional balance sheet for financial and accounting analysis: definition, example and Excel template

The auditor of the company then subjects balance sheets to an audit. Balance sheets of small privately-held businesses might be prepared by the owner of the company or its bookkeeper. On the other hand, balance sheets for mid-size private firms might be prepared internally and then reviewed over by an external accountant. Balance sheets include assets, liabilities, and shareholders’ equity.

- You can also compare your latest balance sheet to previous ones to examine how your finances have changed over time.

- If you’ve found that your balance sheet doesn’t balance, there’s likely a problem with some of the accounting data you’ve relied on.

- Lenders will factor them into their decisions when doing risk management for credit.

- The auditor of the company then subjects balance sheets to an audit.

- Shareholders’ equity is calculated by subtracting a company’s liabilities from its assets.

How do you calculate shareholders’ equity?

The ending cash balance on the cash flow statement (CFS) must match the cash balance recognized on the balance sheet for the current period. While current assets can be converted into cash within a year, liquidating non-current assets, such as fixed assets (PP&E), can be a time-consuming process. The two funding sources available for companies are liabilities and shareholders’ equity, which reflect how the resources were purchased.

Liquidity

If this balance sheet were from a US company, it would adhere to Generally Accepted Accounting Principles (GAAP), and the order of accounts would be reversed (most liquid to least liquid). Just as assets are categorized as current or noncurrent, liabilities are categorized as current liabilities or noncurrent liabilities. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. HBS Online’s CORe and CLIMB programs require the completion of a brief application.

Great! The Financial Professional Will Get Back To You Soon.

Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. Current assets refer to assets that a company can easily convert into cash within a financial year. This category includes readily available funds in the bank, inventory stock, and accounts receivable, which is money owed to the company by its customers.

Calculating working capital requirements (WCR)

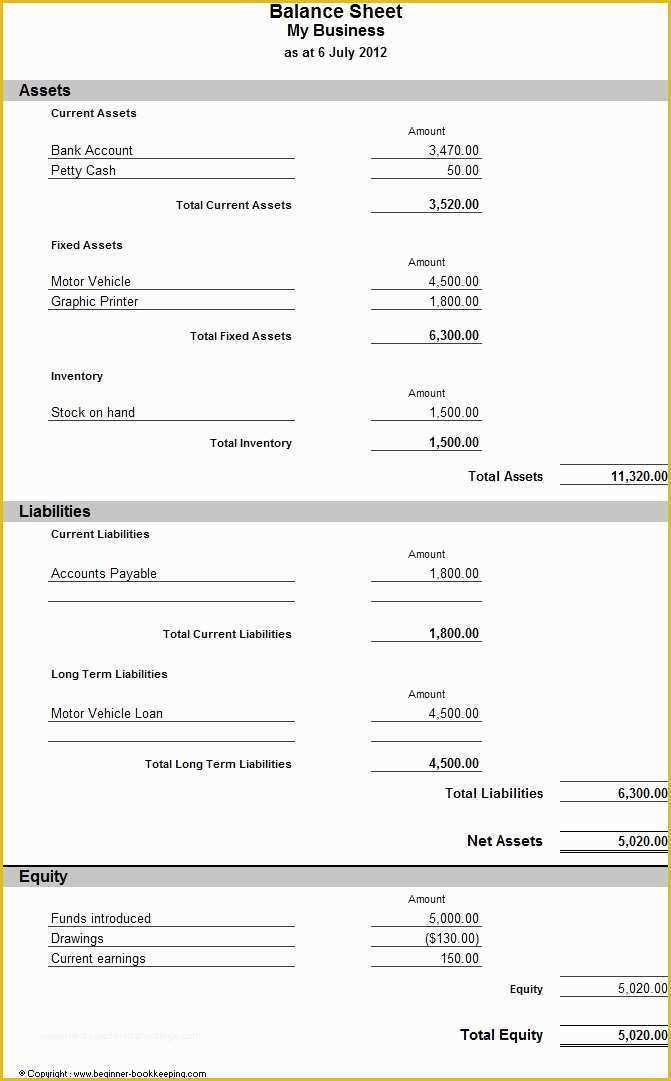

It is also a valuable tool for management to know the value of assets a business owns, including equipment, bank balance and what it owes at any given time. A balance sheet depicts many accounts, categorized under assets and liabilities. Like any other financial statement, a balance sheet will have minor variations in structure depending on the organization. Following is a sample balance sheet, which shows all the basic accounts classified under assets and liabilities so that both sides of the sheet are equal.

Business

Current asset accounts include cash, accounts receivable, inventory, and prepaid expenses, while long-term asset accounts include long-term investments, fixed assets, and intangible assets. A balance sheet serves as reference documents for investors and other stakeholders to get an idea of the financial health of an organization. It enables them to compare current assets and liabilities to determine the business’s liquidity, or calculate the rate at which the company generates returns. Comparing two or more balance sheets from different points in time can also show how a business has grown.

The second is earnings that the company generates over time and retains. If you were to add up all of the resources a business owns (the assets) and subtract all of the claims from third parties (the liabilities), the residual leftover is the owners’ equity. Because companies invest in assets to fulfill their mission, you must develop an intuitive understanding of what they are. Without this knowledge, xero now it can be challenging to understand the balance sheet and other financial documents that speak to a company’s health. It is also convenient to compare the current assets with the current liabilities. For example, even the balance sheet has such alternative names as a “statement of financial position” and “statement of condition.” Balance sheet accounts suffer from this same phenomenon.

Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity, profitability, and debt-to-equity ratio. Balance sheets are one of the most critical financial statements, offering a quick snapshot of the financial health of a company. Learning how to generate them and troubleshoot issues when they don’t balance is an invaluable financial accounting skill that can help you become an indispensable member of your organization. By comparing your income statement to your balance sheet, you can measure how efficiently your business uses its total assets. For example, you can get an idea of how well your company can use its assets to generate revenue. The difference between a company’s total assets and total liabilities results in shareholders’ equity (or “net assets”).