Net Operating Income Meaning, Formula, How To Calculate?

You can use this information to fast-track the efficiency of the core operations and set financial goals. Also, it can hint you at the expenses on direct and indirect costs (especially costs on maintenance of equipment). Net operating income is a profitability metric used to calculate the gains made from an income generating property. It is calculated by deducting operating expenses of the property from the operating revenue. Yes, a company can report a high operating income while still incurring an overall loss.

How Do You Calculate Operating Profit?

Operating revenue is the revenue generated from day to day operations of a business. We can take the example of a company involved in the business tax filing options 2021 of selling mobile phones. Now in a financial year, a company has sold mobiles worth $500,000 and equipment at $100,000, earning a profit of $5000.

Indirect Costs

It also represents the nine month period for the company through the end of Q3. In this formula, net revenue is used in case there have been product returns or other deductions to make to gross revenue. Sales revenue or net sales is the monetary amount obtained from selling goods and services to business customers, excluding merchandise returned and any allowances/discounts offered to customers. To compute the contribution margin ratio, divide total contribution margin by total sales.

Formula and Calculation of Operating Profit

Direct costs refer to charges directly related to the purchase of a product or the offer of services. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. Operating income can also be used to compare the performance of different business units or divisions within a company. By comparing the operating income of different units, managers can identify areas of strength and weakness and make informed decisions about resource allocation and strategic planning.

Bill is working on refinancing his current loans with a new bank, so he has to prepare a multiple step income statement with a detailed operating section. Operating income and EBIT are the same for many companies, but for those that have large incomes or losses from the “other” category, the differences can be substantial. Furthermore, there’s usually an industry average, which is helpful in calibrating company performance and determining whether the profit generated at each stage is reasonable. Some are also one-off items that have nothing to do with the day-to-day operations. Operating income is listed on a company’s income statement, which can be found on the SEC website and the company’s investor relations page. You can find the income statements of all publicly traded companies for free online, both on the SEC website and the companies’ investor relations pages.

- From the example above, gross profit was $700,000 for the period, achieved by subtracting $150,000 in COGS from the revenue of $850,000.

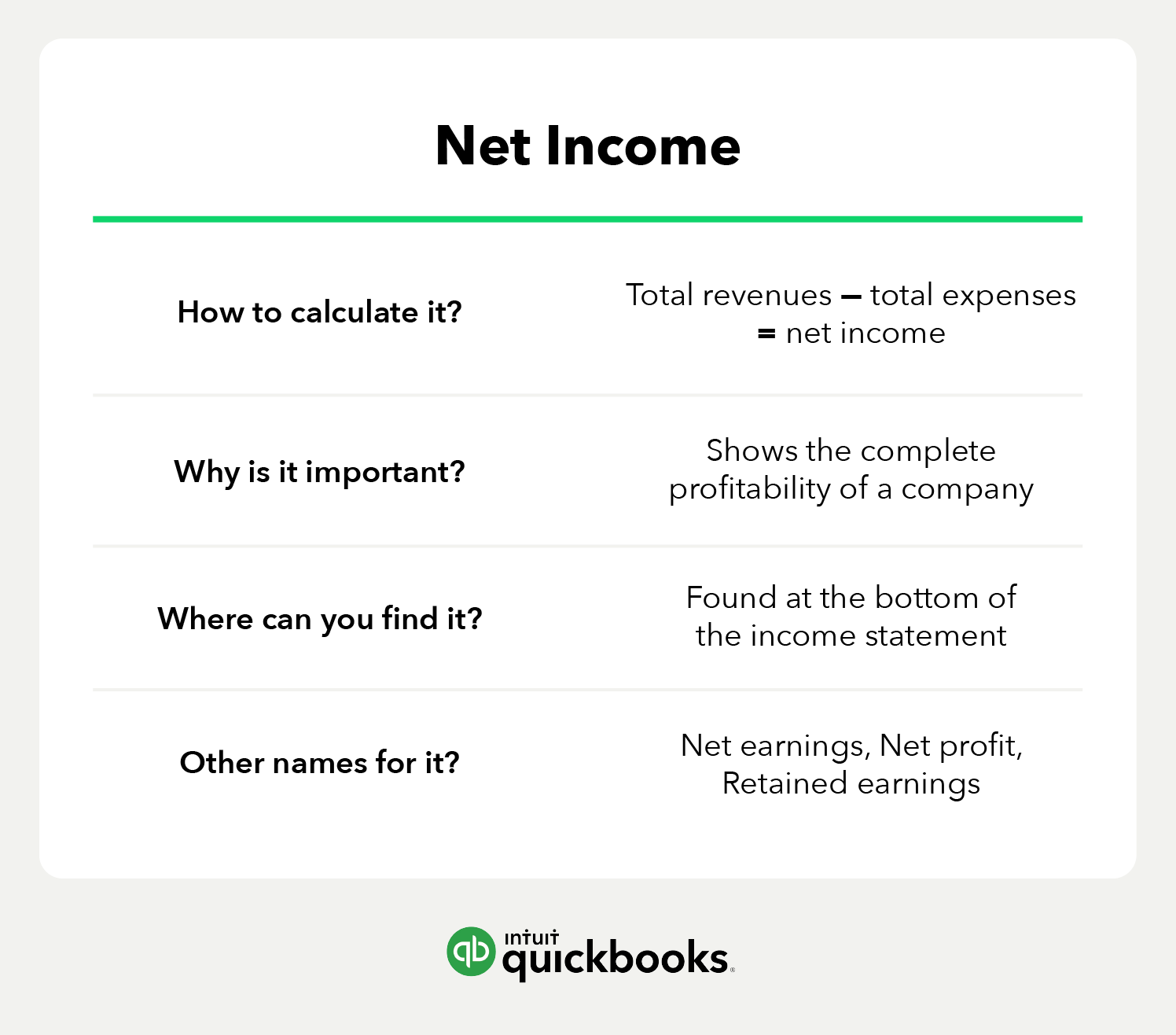

- Other calculations of profit, income or earnings, such as gross income, EBIT and operating income, are all more specific interpretations of net income that exclude certain revenues and expenses.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

- Management uses this measure of earnings to gauge the profitability of various business decisions over time.

Would you prefer to work with a financial professional remotely or in-person?

The operating income formula is calculated by subtracting operating expenses, depreciation, and amortization from gross income. In contrast to operating income, non-operating income is the portion of an organization’s income that is derived from activities not related to its core business operations. It can include items such as dividend income, interest, gains or losses from investments, as well as those incurred in foreign exchange and asset write-downs. Gross profit is the net profit earned after the cost of goods sold is subtracted from net revenue.

Operating expenses are the selling, administrative, and general expenses necessary to operate a business, though this does not include interest or taxes. Because operating expenses do not incorporate allocated costs, depreciation and amortization must also be subtracted. Management uses this measure of earnings to gauge the profitability of various business decisions over time. Operating profit is a useful and accurate indicator of a business’s health because it removes any irrelevant factor from the calculation. Operating profit only takes into account those expenses that are necessary to keep the business running.

However, looking further down its income statement, the company’s operating income for the three-month period was $23.076 billion, less than the $24.126 billion from the year before. If a company does not have interest expenses, tax expenses, or other non-operational costs, it is possible for a company’s operating income to be the same as its net income. Let us consider an example to calculate EBIT for a company called ABC Limited, which manufactures customized roller skates for both professional and amateur skaters. At the end of the financial year, the company had generated $150,000 in total revenue and the following expenses.